USD Recent News

Top Stories

Rhonda Harley, PhD, Honored with 2026 Outstanding Leadership Award

The University of San Diego (USD) Shiley-Marcos School of Engineering is proud to announce that Rhonda Harley, PhD, has been named the recipient of the 2026 Outstanding Leadership in Engineering Award by the San Diego County Engineering Council. This prestigious honor recognizes San Diego’s premier leaders and educators who excel in advancing innovation, leadership and inclusive excellence within the engineering profession.

University of San Diego and U.S. Bank expand partnership with new debit card design

University of San Diego supporters can now show their Torero pride every time they use the new U.S. Bank Visa® Debit Card with the University of S…

Biochemistry Major Shukriya Osman Recognized for Excellence with the Kyle O’Connell Memorial Scholarship

The University of San Diego Department of Chemistry and Biochemistry is delighted to announce that Shukriya Osman, a junior majoring in Biochemistry w…

Finding the Rhythm: Assistant Professor Karen López Alonzo Reimagines Heritage Spanish Courses

When Assistant Professor of Languages, Cultures and Literatures Karen López Alonzo, PhD, reflects on teaching, she thinks about salsa dancing. …

Watch: USD News Minute for February 9

USD News Minute: What you need to know this week at USD…

USD Establishes New Academic Partnership With University of Monterrey

The University of San Diego has signed a Memorandum of Understanding with the University of Monterrey to strengthen education, research and innovation…

At the Edge of It All Podcast: How the Brain Makes Sense of the World Through Emotion

Monica Thieu, assistant professor in the Department of Neuroscience, Cognition, and Behavior at USD, joined "At the Edge of It All" to discuss how the…

USD Faculty Light the Way Forward: Maren Mossman

University of San Diego faculty light the way forward through teaching, research, and scholarship. Maren Mossman, Clare Booth Luce assistant professor…

Video: USD in the News Highlights for January 2026

Watch a 3-minute highlight video of USD's appearances in the media for the month of January 2026.…

From Cybersecurity to Center Stage: USD Alumna Taylor Wong Harmonizes Tech and Art

For Taylor Wong ’19 (CS), blending a career in cybersecurity with a passion for music isn’t a contradiction — it’s a calling. …

Watch: USD News Minute for February 2

USD News Minute: What you need to know this week at USD…

From President Harris: Toreros Together Resources and Links

In President Harris’ January 28 message to the campus community, he outlined a number of important resources and engagement opportunities for st…

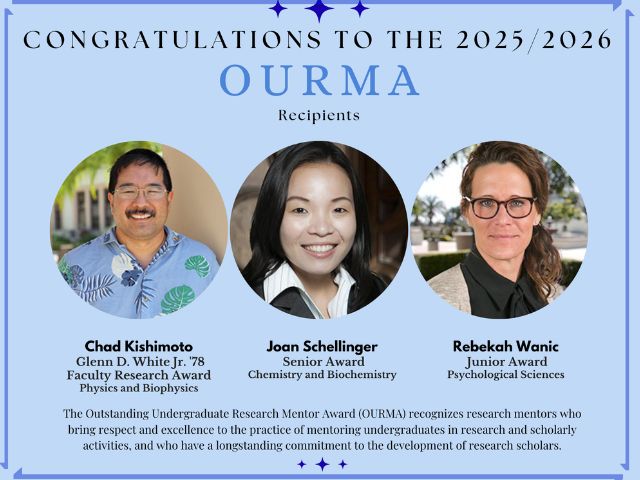

Congratulations to the 2025-26 OURMA Recipients

The Office of Undergraduate Research is very excited to announce the 2025-26 Outstanding Undergraduate Research Mentor Award (OURMA) recipients. …

USD History Professor Named Fellow of Medieval Academy of America

Professor of History Thomas Barton, PhD, has been elected a Fellow of the Medieval Academy of America, the highest honor for North America-based schol…

At the Edge of It All Podcast: The Athletics Edge - Blanche Alverson on Her Debut Season and Raising Awareness for Cancer

This week, "At the Edge of It All" was joined by USD Women's Basketball Head Coach Blanche Alverson.…

Anthony Shao Leads Darroch Medical Toward Transformative Healthcare Solutions

When Anthony Shao ’18 first considered his career path, health care was not at the top of his list. As a double-major electrical engineering and…

Toreros Together for the Common Good - Spring Programming Lineup

As part of the 'Year of Wellness,' USD students are invited to participate in a comprehensive program dedicated to holistic health and community build…

Watch: USD News Minute for January 26

USD News Minute: What you need to know this week at USD…

Finding Her Rhythm

Sunrise over the bay is an awesome sight, but for rower Annika Goodwyn, the true beauty is the synergy inside the shell as she and team…

An Unexpected Recipe for Wellness

Sometimes the most unlikely path leads to the greatest personal fulfillment. It’s a sentiment Trishika Tabuena ’22 (MS) knows well&nb…

At the Edge of It All: How Teens Can Solve Global Problems with an Innovator's Mindset

Ashley Ahrens-Víquez, Program Operations and Engagement Manager for The Jacobs Institute for Innovation in Education at the University of San D…

Ricardo Valerdi, PhD: Bringing Math to Life Through the Science of Sport

In 2013, Dr. Ricardo Valerdi ’00, a proud electrical engineering alumnus of the University of San Diego (USD), had a radical idea: what if we us…

Watch: USD News Minute for January 20

USD News Minute: What you need to know this week at USD…

Wellness By Students, For Students

Before the doors to the Palomar Health Student Wellness Center opened in April, Kimmel Yeager arrived several months earlier for her newly created pos…

At the Edge of It All: The Psychology Behind Building a Positive Mindset

How does our mindset play a role in how we tackle everyday challenges? And, what is the science behind it?…

Wellness Redefined

At USD’s Palomar Health Student Wellness Center, wellness isn’t just a routine — it’s a lifestyle, a place where students are …

Carnegie Foundation Selects the University of San Diego as the Host for Community Engagement-Classified Universities

The University of San Diego (USD) was selected as one of 237 U.S. colleges and universities to receive the 2026 Carnegie Community Engagement (CE) Cla…

Video: USD in the News Highlights for December 2025

Watch a 3-minute highlight video of USD's appearances in the media for the month of December 2025.…

Answering the Call

"Running to the fire." The phrase is central to the mission and ethos of the international aid organization, Samaritan’s Purse,…

At the Edge of It All: How Wetlands Play an Essential Role in Connecting Habitats

Drew Talley, professor of Environmental and Ocean Sciences, joined the "At the Edge of it All" podcast to talk about his journey into studying wetland…